Oil prices fell sharply in Asian trade on Monday, extending recent declines after U.S. President Donald Trump largely doubled-down on his recent trade tariffs, ramping up concerns over slowing economic growth and weakening demand.

China- the world's biggest oil importer- retaliated against Trump's tariffs over the weekend, while other majors such as the European Union outlined plans for retaliation, driving up concerns over a global trade war.

This notion had battered oil prices through the last week, as traders feared worsening economic growth, which could in turn dent global oil demand.

Brent oil futures fell 2.5% to $63.93 a barrel- their weakest level since April 2021, while West Texas Intermediate crude futures fell 2.4% to $60.16 a barrel by 21:31 ET (01:31 GMT).

Trump doubles down on tariffs, no deals until trade deficit fixed

Trump told reporters on Sunday evening that markets will have to treat the tariffs as "medicine," and that he had no plans to back off on his tariff plans.

Trump's recently unveiled round of reciprocal tariffs- which outline duties as high as 54% against China- are set to take effect from April 9.

The U.S. President said the tariffs were aimed at fixing the U.S. trade deficit with other major economies, and will remain in place until the deficit is "cured."

China retaliated against Trump's duties with 34% tariffs on all U.S. imports, while also decrying Trump's tariffs and threatening more measures.

Traders fear that Trump's tariffs will spark economic carnage across the globe, undermining growth and denting demand for oil.

Top oil importer China is also expected to be the worst hit by the new tariffs, which amount to a cumulative 54%.

Goldman Sachs slashes oil price forecasts on tariff jitters

Goldman Sachs had last week cut its 2025 Brent price average by 5.5% to $69/barrel, while WTI prices are expected to average at $66/barrel.

The investment bank cited heightened risks to oil from a brewing global trade war, which could trigger a recession.

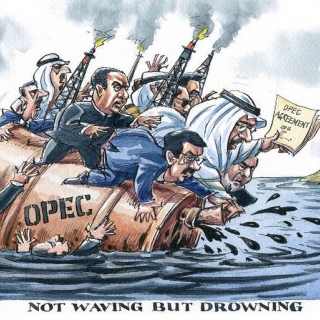

Goldman Sacha also warned that any measures by the Organization of Petroleum Exporting Countries and allies (OPEC+), to increase production, stood to dent oil prices.

Several OPEC+ members recently outlined plans to increase production in May, catching markets off guard and raising concerns over even greater supplies in the coming months.

Oil was also spooked last week by data showing a substantially bigger-than-expected build in U.S. inventories.

Source: Investing.com

Oil prices slid about 2% on Thursday on concerns over softening U.S. demand and broad oversupply that offset threats to output from the conflict in the Middle East and the war in Ukraine. Brent crude...

Oil prices fell on Thursday (September 11), pressured by concerns over weakening US demand and a widespread oversupply, offsetting the threat to production from conflicts in the Middle East and Russia...

Oil prices held steady on Thursday (September 11th) as concerns over weakening US demand and the risk of a wider oversupply were offset by concerns over attacks in the Middle East and Russia's war in ...

Global oil prices stabilized after three consecutive days of gains. The market weighed US President Donald Trump's latest comments on Russia and the possibility of punitive measures for the war in Ukr...

Oil prices settled higher on Wednesday by more than $1 a barrel as investors worried about possible supply disruptions after Poland downed drones in its airspace and the U.S. pushed for new sanctions ...

Gold price trimmed some of its earlier losses on Thursday, yet it remains negative in the day, down over 0.14% as the latest print of consumer inflation was aligned with estimates. Nevertheless, jobs data outweighed August's Consumer Price Index...

Oil prices slid about 2% on Thursday on concerns over softening U.S. demand and broad oversupply that offset threats to output from the conflict in the Middle East and the war in Ukraine. Brent crude futures were down $1.11, or 1.6%, to $66.38 a...

United Arab Emirates President Sheikh Mohammed bin Zayed Al Nahyan's tour of Gulf countries is aimed at coordinating positions after Tuesday's Israeli attack on Hamas leaders in Doha, his diplomatic adviser said on Thursday. "The President's Gulf...

The United States (US) Bureau of Labor Statistics (BLS) will publish the 2025 preliminary benchmark revision to the Establishment Survey Data on...

The United States (US) Bureau of Labor Statistics (BLS) will publish the 2025 preliminary benchmark revision to the Establishment Survey Data on...

The Federal Reserve is likely to start a series of interest-rate cuts next week and keep going through the end of the year, traders bet on Wednesday...

The Federal Reserve is likely to start a series of interest-rate cuts next week and keep going through the end of the year, traders bet on Wednesday...

Producer inflation in the United States, as measured by the change in the Producer Price Index (PPI), fell to 2.6% annually in August from 3.3% in...

Producer inflation in the United States, as measured by the change in the Producer Price Index (PPI), fell to 2.6% annually in August from 3.3% in...

The US Bureau of Labor Statistics reported on Tuesday that the preliminary estimate of the Current Employment Statistics (CES) national benchmark...

The US Bureau of Labor Statistics reported on Tuesday that the preliminary estimate of the Current Employment Statistics (CES) national benchmark...